24. Feb 2021

BSRIA Finds Building Automation Controls Market Set to Bounce Back after Hit by COVID-19

BSRIA has updated its forecasts for Building Automation Controls (BACS) based on research into the major global markets.

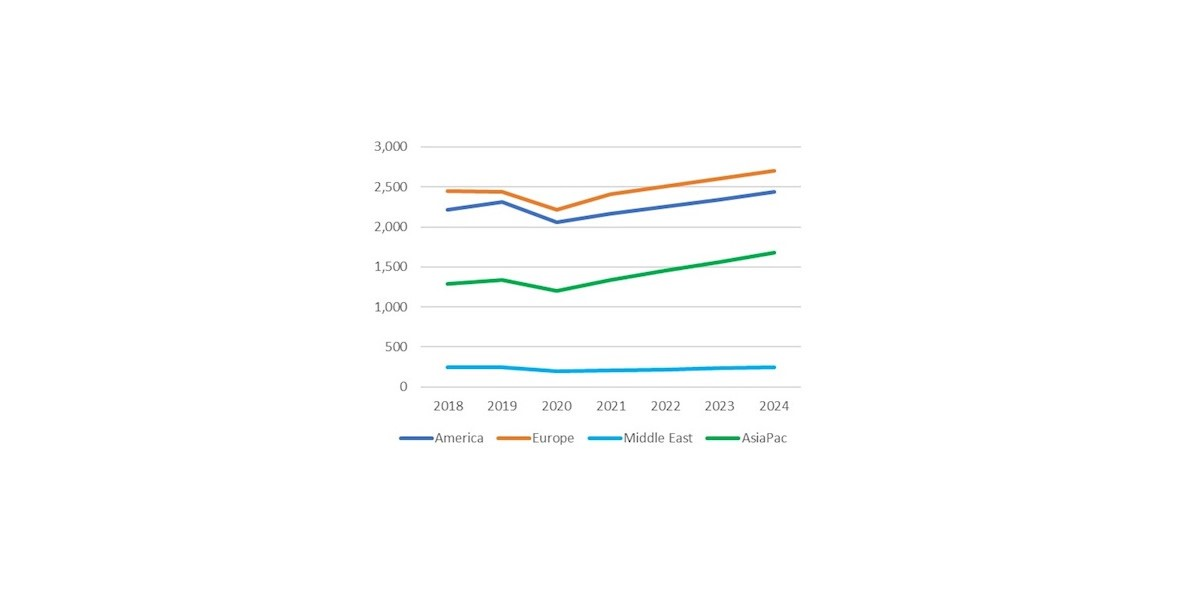

The short- term impact of COVID-19 has been significant, with the global BACS market declining by an expected 10% in 2020 instead of the 4% growth forecasted in March last year.

All the major geographical regions have been hit, though the Middle East has seen a particularly sharp contraction. Nevertheless, the latest BSRIA research uncovered considerable variation within regions. In Europe, for example, the German market has suffered less than France, Italy or the UK. This reflects the relative severity of the impact of COVID-19 in terms of lockdowns and reduced economic activity.

North America has seen a decline in line with the world's average, in Asia, China has staged a strong recovery, reflecting its relative success in containing the pandemic, while India, in contrast, has been hit hard, with much of the industrial economy curtailed.

Forecasts of future recovery depend heavily on how far and how fast the pandemic is brought under control, but recent announcements about vaccines increases the likelihood of the return to more normal conditions in some countries during 2021.

Our findings confirm that verticals including hotels and hospitality and transport have been particularly hard hit by the pandemic, with many companies adopting a ‘wait and see' approach. In contrast many countries have been increasing investment in health facilities, both to increase the number of patients that can be treated and to improve the environment offered.

We are also seeing signs that the theme of wellbeing in buildings, which was already much talked about before the pandemic, is increasingly reflected in sales of actual solutions, whether it is a case of improving ventilation and air quality or monitoring the location of people within a building to maintain a safe environment.

Another sector which has been performing strongly has been data centres, where existing growth has been accelerated by the move towards online retail and remote working.

While all BACS product categories have been hit by the pandemic, software has seen only a small dip in sales, and is forecast to continue its strong long-term growth. This underlines the key trend that the added value of "smarter" buildings is underpinned by the collection and analysis of increasingly rich sources of data about the buildings performance which can then be used to improve performance further, when it comes to energy management, wellbeing or other objectives.

In Europe in particular, initiatives by the European Union and by national governments are likely to encourage building owners to install BACS or similar solutions as a means of meeting energy efficiency targets, especially in smaller buildings where BACS might not previously have been seen as cost-effective.

The net result of all these changes is that the period 2020 - 2024 will still see growth in the global BACS market but at a lower rate than originally forecast in March.

BSRIA's reports provide detailed information about how specific countries and BACS products are likely to be affected by the pandemic.

Highlights

-

News

NewsThe KNX Journal 2025 is now available

The latest edition of our annual smart home and building solutions magazine has arrived. The KNX Journal 2025 offers ... -

News

NewsNew ETS App: Password Manager

The ETS Password Manager is a powerful new ETS App introduced in ETS 6.3 that eliminates the need to repeatedly enter ... -